Donald Trumps Insurance, Trump Signs Executive Order On Health Care, Scraps ACA Subsidies. How Much Is The ACA Penalty?

Donald Trumps Insurance, Trump Signs Executive Order On Health Care, Scraps ACA Subsidies video duration 10 Minute(s) 5 Second(s), published by Small Insurance Companies on 03 03 2018 - 03:26:25.

Donald Trumps Insurance, Trump Signs Executive Order On Health Care, Scraps ACA Subsidies.

April 9 (UPI) -- The Trump administration rewrote rules regarding health care plans sold through Affordable Care Act marketplaces Monday, providing new ...

For tax year 2016, the penalty will rise to 2.5% of your total household adjusted gross income, or $695 per adult and $347.50 per child, to a maximum of $2085.

Thank for Watching.! Please Like Share And SUBSCRIBE.! #healthcare #familyhealth #nutritionnews #animation ACA's state-run insurance exchanges fare ...

Doctor to Senator Boozman: Tax Bill and ACA wrapped together and mortality goes up when insurance goes down.

Other Video :- Trump administration creates new exemptions under ACA mandate

April 9 (UPI) -- The Trump administration rewrote rules regarding health care plans sold through Affordable Care Act marketplaces Monday, providing new ... - How Much Is The ACA Penalty?

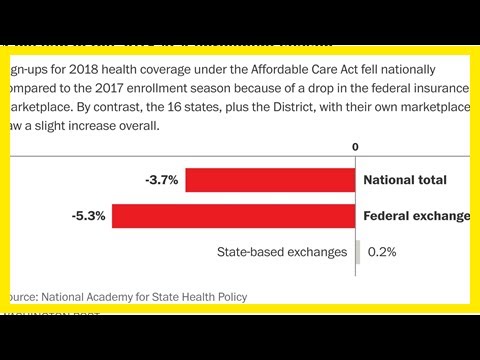

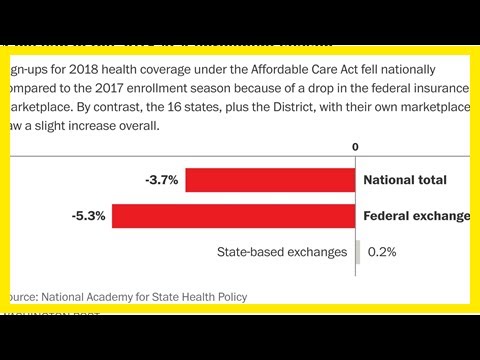

For tax year 2016, the penalty will rise to 2.5% of your total household adjusted gross income, or $695 per adult and $347.50 per child, to a maximum of $2085. - ACA’s state-run insurance exchanges fare better than the law’s federal marketplace

Thank for Watching.! Please Like Share And SUBSCRIBE.! #healthcare #familyhealth #nutritionnews #animation ACA's state-run insurance exchanges fare ... - Tax Bill and ACA wrapped together and mortality goes up when insurance goes down

Doctor to Senator Boozman: Tax Bill and ACA wrapped together and mortality goes up when insurance goes down.

Share this :

- Trump administration creates new exemptions under ACA mandate

April 9 (UPI) -- The Trump administration rewrote rules regarding health care plans sold through Affordable Care Act marketplaces Monday, providing new ... - How Much Is The ACA Penalty?

For tax year 2016, the penalty will rise to 2.5% of your total household adjusted gross income, or $695 per adult and $347.50 per child, to a maximum of $2085. - ACA’s state-run insurance exchanges fare better than the law’s federal marketplace

Thank for Watching.! Please Like Share And SUBSCRIBE.! #healthcare #familyhealth #nutritionnews #animation ACA's state-run insurance exchanges fare ... - Tax Bill and ACA wrapped together and mortality goes up when insurance goes down

Doctor to Senator Boozman: Tax Bill and ACA wrapped together and mortality goes up when insurance goes down.

0 Comment

Write markup in comments